Free Last Will and Testament Template - PDF

We'll guide you through the nuances of creating a Will or Living Trust, helping you understand their differences and how they can best serve your estate planning needs. Whether you're looking to safeguard your legacy with a living trust or you're considering the traditional path of a Will, we've got you covered. Get started today with creating a free living trust or downloading our free will template.

Select your state below:

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

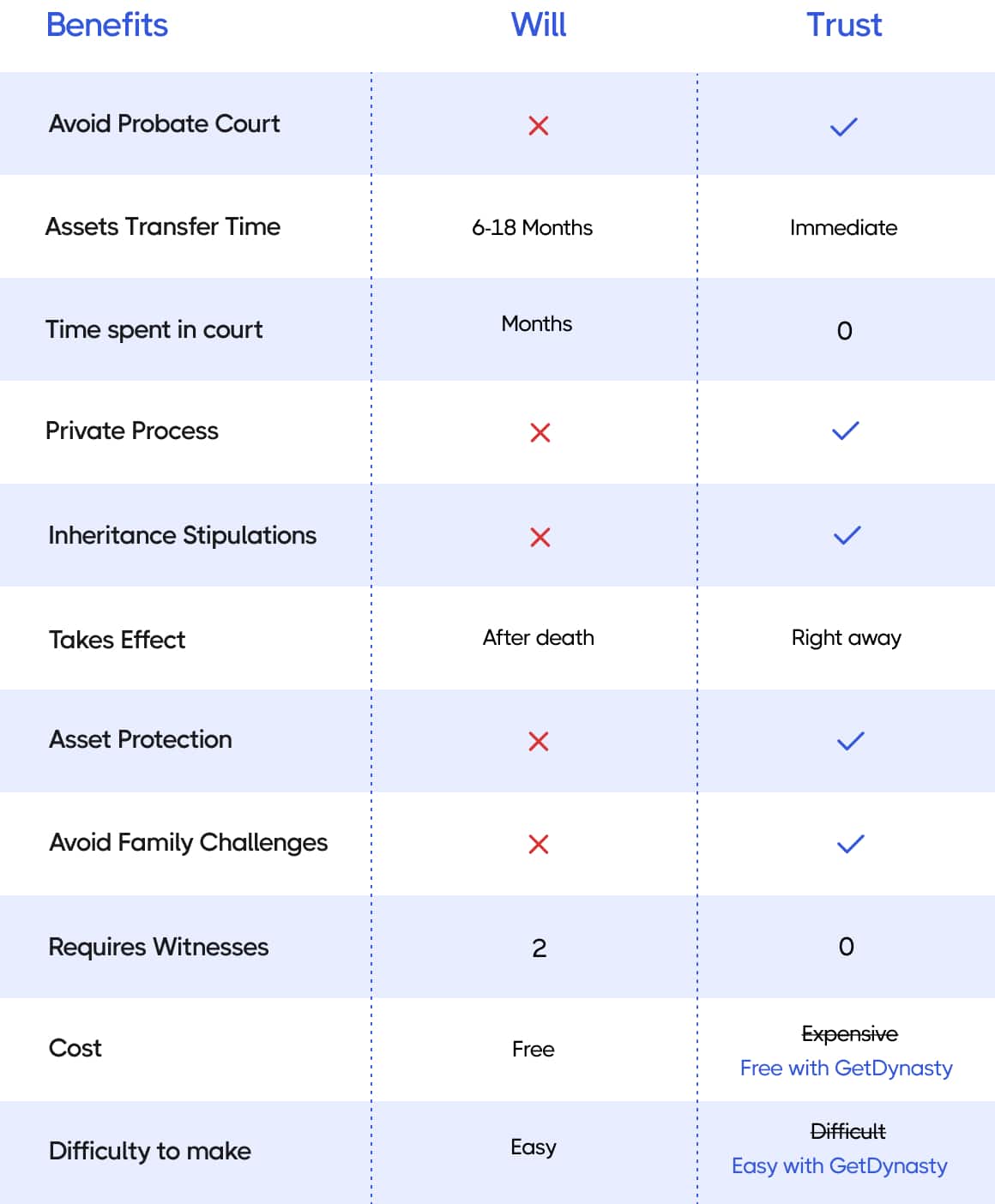

Living Trust vs Will: Which one is better?

To put it simply, Living Trusts are significantly better than Wills in many aspects but the most important reason is that a Trust allows you to bypass the probate process, which is the expensive, lengthy, and stressful 6-12 month process where courts validate Wills and distribute assets to beneficiaries. This process can be extremely stressful for your family. Both tools can be used simultaneously in estate planning, with a Will often serving as a “backup” to capture any assets unintentionally left out of a trust. Deciding between a Will, a Trust, or using both depends on individual circumstances and objectives. Read more about The Benefits of a Living Trust

How are they different?

- Will: A legal document that specifies how an individual’s assets will be distributed upon their death.

- Trust: A legal entity where one party, the trustor, grants another party, the trustee, the right to hold and manage assets for the benefit of third parties, the beneficiaries.

- Will: Assets specified in a Will go through the probate process, where a court ensures the deceased person’s wishes (as specified in the will) are followed. This can take 6-12 months and be very expensive.

- Trust: Assets held in a trust typically bypass the probate process. This can result in a significantly faster, less costly asset distribution. Saving your family from expensive legal fees.

- Will: Because it goes through probate, a will becomes a public record, which means anyone can access its contents.

- Trust: Remains private, and its details aren’t usually accessible to the public. You can also create a Trust using an anonymous name to increase privacy further.

Control:

- Will: Provides instructions for asset distribution upon death.

- Trust: With a living trust, you can set specific conditions on how your assets are managed and distributed. For example, you can stagger distributions to beneficiaries or set up provisions to protect assets for minor children or beneficiaries with special needs. This level of flexibility is often more challenging to achieve with a will.

- Will: Does not provide any particular protection against creditors or lawsuits.

- Trust: Certain types, like irrevocable trusts, can offer protection against creditors or legal claims. As well as protection from family disputes.

- Will: No tax benefits.

- Trust: Certain trusts can provide tax advantages or help in estate tax planning.

How are they similar?

A Will and a Living Trust share several similarities in the realm of estate planning. Both tools allow individuals to specify how they want their assets distributed after their death. They also allow the grantor (the person creating the document) to designate beneficiaries, which are individuals or entities that will receive assets from the estate. In both cases, the grantor can update or modify the terms as long as they are alive and mentally competent. Moreover, both Wills and Living Trusts can include provisions that dictate particular wishes or instructions, such as how a particular asset should be managed or who should care for minor children.

Additionally, the validity of both Wills and Living Trusts can be contested in court, although the grounds and procedures for contesting might differ. Finally, both tools play an instrumental role in comprehensive estate planning, often working in conjunction with one another to ensure all aspects of one’s estate are addressed.

Ultimate Will Vs Trust Comparison Chart

Benefits of a Will

Control and autonomy

Creating a will lets you decide who will inherit your assets, including money, property, and personal belongings. You have the power to ensure your things go to the people or causes you care about the most.

Guardianship of minors:

If you have young children, a will allows you to appoint a guardian to care for them if both parents pass away. It gives you peace of mind knowing your kids will be taken care of by someone you trust.

Avoiding family conflicts:

Your living trust is constantly changing and can be expensive to adjust. With Dynasty Advantage you can make updates to your Trust with just with a few clicks and save up to $1000 every time.

Better probate process

With a will in place, the legal process of distributing your estate, known as probate, can be more streamlined and faster, reducing stress for your loved ones during a difficult time.

Philanthropic opportunities

Through a will, you have the chance to leave part of your estate to charitable organizations or causes you support, leaving a positive impact on society.

Peace of mind

Your living trust is constantly changing and can be expensive to adjust. With Dynasty Advantage you can make updates to your Trust with just with a few clicks and save up to $1000 every time.

Frequently asked questions about Wills

If I move to another state, is my Will still valid?

If you move to another state, a will that was validly executed in your previous state is generally still considered valid in your new state. However, there are some important nuances to consider:

Different State Laws: Although many states have similar basic requirements for will validity, such as the testator’s age and mental capacity and the necessity for witnesses, the specific details can vary. Some states may have nuances in their requirements that could potentially impact the validity or interpretation of certain provisions in your will.

Property and Specific References: If you acquire property in your new state or if there are specific references in your will that are tied to your previous state, these might need reconsideration and potential revision to suit your new state’s laws or context.

Executor/Appointee Regulations: Some states have specific regulations concerning out-of-state executors or other appointees. If your will names someone from your previous state as your executor, the new state might impose additional requirements or restrictions on them.

Marital Property: Moving between community property states and common law property states can affect how marital property is viewed and divided. If you move from or to a community property state, this change could have implications for how assets are distributed in your will.

New State’s Provisions for Out-of-State Wills: Some states have provisions that specifically address the validity of wills executed in other states. These provisions might explicitly validate out-of-state wills if they were validly executed under the laws of the originating state.

Recommendation: While your will might remain valid after moving, it’s prudent to consult with an estate planning attorney in your new state. They can review your will to ensure it complies with the new state’s laws and can advise on any updates or revisions that might be beneficial or necessary. Reviewing your will after a move is a proactive approach that can prevent potential complications and disputes in the future.

What is an Executor and what do they do?

The executor of a will, sometimes referred to as a “personal representative” or “administrator” in jurisdictions or circumstances where there’s no will, has a broad range of responsibilities. These duties ensure that the deceased person’s final wishes are carried out and that the estate is properly managed and distributed. Here are the primary responsibilities of an executor:

- Probate Process Initiation

- Inventory of Assets

- Property Management

- Paying Debts and Taxes

- Filing Necessary Paperwork

- Distributing Assets

- Handling Challenges

- Maintaining Records

- Closing the Estate

- Communication

- Seeking Professional Assistance

Read our full article that breaks down the requirements and responsibility of Executors.

Being an executor is a role that carries significant responsibility and requires attention to detail, organization, and often a significant time commitment. If someone feels unqualified or overwhelmed by the duties, they can seek professional assistance or, in some cases, choose to decline the role altogether.

When is probate not required for a Will?

Every state has a minimum estate value for it to require probate, this is called the Small Estate Affadavit.

A Small Estate Affidavit is a legal document that allows for the transfer of assets from a deceased individual without the need to go through a formal probate process. It’s a simpler, more streamlined method designed for estates that fall below a certain value and meet specific criteria.

View our full article on Small Estate Affidavit and each States Requirements.

What happens if I die without a Will?

If you die without a Will, you are said to have died “intestate.” When this happens, the distribution of your assets is determined by the intestacy laws of the state or jurisdiction in which you reside, and potentially where your assets are located if you own property in multiple jurisdictions.

Can a Will be contested in Court?

Yes, Wills can be contested in court, usually by potential heirs or beneficiaries who believe they were wrongly excluded or if they believe the Will was created under duress, fraud, or when the person was of unsound mind. This is the primary reason we recommend Creating a Free Living Trust instead.

Can I disinherit someone in a Will?

Yes, individuals can choose to exclude certain family members from inheriting. However, some jurisdictions have laws that protect certain beneficiaries, like spouses, from complete disinheritance. However this usually requires a Lawyer and may not be available in most downloadable templates.

How often should I update my Will?

The frequency with which you should update your Will depends on the changes in your life circumstances. While there’s no set rule for how often a Will should be updated, it’s advisable to review and potentially revise it after significant life events. Some of these events include:

Marriage or Divorce: These events can significantly change how you might want to distribute your assets. A new spouse may not automatically be entitled to your assets, especially if there are children from a previous relationship involved.

Birth or Adoption of a Child: To ensure that your children are taken care of and receive their inheritance as you intend, you should update your Will whenever there’s an addition to your family.

Death of a Beneficiary or Executor: If someone named in your Will passes away, you’ll need to update the document to reflect a new beneficiary or appoint a new executor.

Acquisition or Disposal of Significant Assets: If you acquire property, start a business, or sell a significant asset, it’s essential to update your Will to reflect these changes.

Changes in the Law: Tax and estate laws can change. It’s crucial to review your Will periodically to ensure it remains compliant and beneficial in light of current laws.

Relocation: If you move to a different state or country, the laws governing Wills and estate distribution might be different, necessitating a review or revision of your current Will.

Change in Relationships: If your relationship with an heir or beneficiary changes, you may want to update the Will to reflect your current wishes.

Periodic Review: Even if there are no significant changes in your life, it’s a good practice to review your Will every few years to ensure it still reflects your current wishes and that all information is accurate.

In conclusion, while there isn’t a strict timeline on how often you should update your Will, it’s essential to do so when significant life changes occur. Regular reviews will also help ensure that the document remains current and aligns with your wishes. Consulting with an estate planning attorney during these updates can provide clarity and confidence that your Will is both legally sound and reflective of your intentions.

Why is it important to have a Will?

Having a Will (or Trust) is crucial because it provides clear directives about how an individual’s assets should be distributed upon their death, ensuring that their wishes are respected and followed. Without a Will, the distribution of assets is determined by state or jurisdictional intestacy laws, which might not align with the deceased’s preferences. A Will not only covers asset distribution but can also specify guardianship arrangements for minor children, which can be essential in ensuring that they are cared for by someone the deceased trusted and chose. In the absence of a Will, the courts will decide guardianship, and the chosen guardian may not be someone the deceased would have preferred. Additionally, a Will allows an individual to name an executor, who will be responsible for managing the estate, paying off debts, and ensuring that the deceased’s wishes are carried out accurately and efficiently. Without a designated executor, the court will appoint someone, which could lead to potential delays and conflicts. Overall, having a Will provides clarity, reduces the potential for disputes among heirs or beneficiaries, and offers peace of mind to the individual, knowing that their wishes will be honored after their death.