While a Living Trust can offer significant estate planning benefits, many celebrities have passed away without one, leading to complicated legal proceedings and public scrutiny. Here are five such cases:

Prince:

The iconic musician Prince passed away in 2016 without a will or living trust. As a result, his estimated $300 million estate became the subject of a complex and lengthy probate process involving numerous potential heirs and claims.

Aretha Franklin:

The Queen of Soul, Aretha Franklin, died in 2018 without a will or living trust. Her estate, estimated to be worth $80 million, became subject to probate proceedings and disputes among her four sons and other parties.

Amy Winehouse:

The Grammy-winning singer Amy Winehouse passed away in 2011 without a will or living trust. Her estate, worth an estimated £4.66 million, was distributed to her parents according to the UK’s intestacy laws, leaving her ex-husband and other potential beneficiaries without a share.

Jimi Hendrix:

The legendary guitarist Jimi Hendrix died in 1970 without a will or living trust. His estate, worth millions of dollars, was left to his father under intestacy laws. The lack of estate planning led to ongoing disputes and legal battles among his family members for control over his music and legacy.

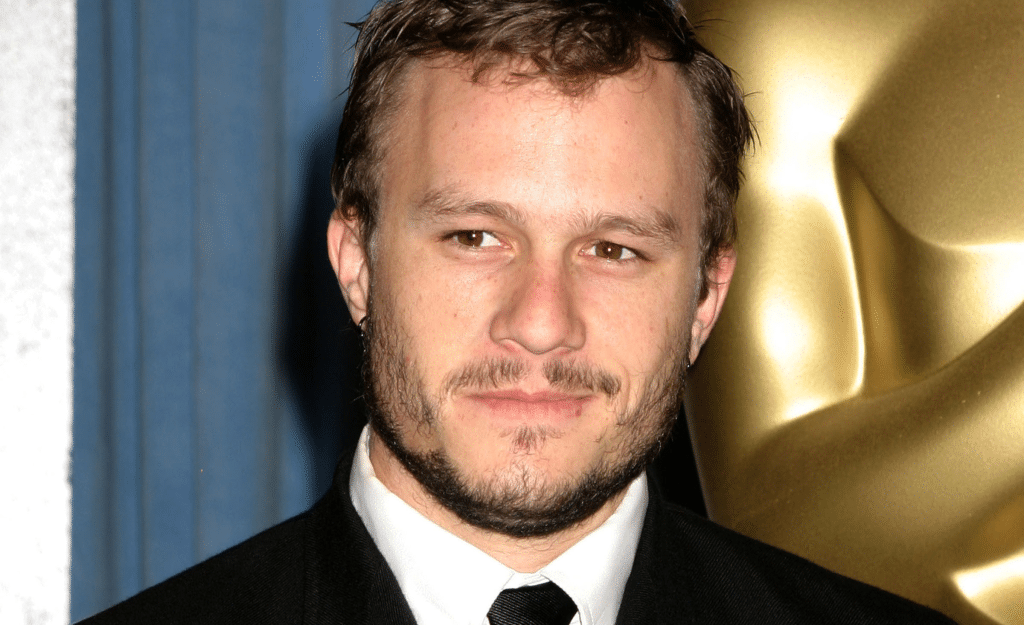

Heath Ledger:

The acclaimed actor Heath Ledger died unexpectedly in 2008 without updating his will or creating a living trust. His will, written before the birth of his daughter, did not include her as a beneficiary. Although his family decided to give his entire estate to his daughter, the lack of proper estate planning could have led to legal disputes and unintended consequences.

These cases highlight the importance of proper estate planning, including the potential benefits of a Living Trust, to ensure that one’s assets are distributed according to their wishes and minimize disputes among heirs.